Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Allen Ding 鼎

Founding Partner of @ResearchNothing | Founder of @ebunker_eth | Founder of @Dbunker_Network|Former Chef Analyst & Head of Staking @Huobiglobal | DYOR

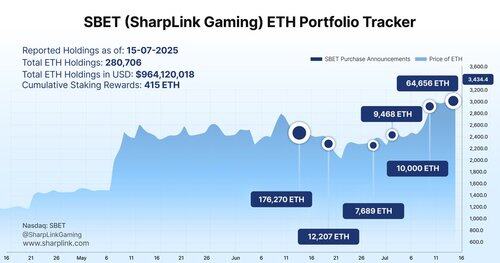

The infinite bullet purchase strategy of listed companies is a fundamental change for ETH, an asset with relatively low inflation, staking income, and a relatively small market capitalization.

In 2023, I communicated with many listed company bosses and suggested that they implement the ETH treasury strategy, which is a pity. People are always used to "believe because they see". And truly great investment should always be "seeing because you believe".

Think about it again, now eth gas is still so low, ecology is so cool, and TPS is still so low, what will happen if these three are improved?

Welcome to communicate with institutional DMs with ETH treasury strategic plans, @ebunker_eth as the largest ETH staking company in Asia, we are willing to provide you with ideas and technical help.

17,51K

Have you ever seen a bull market? I've seen it, December 2020 - May 2021.

All technical indicators fail, all air forces are fuel, and all buy-ins make money.

Allen Ding 鼎16.7. klo 13.41

Familiar feelings are coming, and the last time I felt this was in December 2020

72,06K

There have been too many people chatting privately lately, so let's summarize my opinions:

1. The essence of the treasury strategy is infinite bullets + the attention of the stock market.

2. Emotions have continuity and inertia, and ETH's emotions have just begun to detonate for 10 days. Unless there is a huge bearishness, the trend will not reverse.

3. There are still a large number of people who don't get on the ETH, or get off halfway. Because ETH has spent a whole year cultivating everyone's empty thinking.

4. The treasury strategies of other currencies have not formed a large-scale consensus at present, so the effect is not as good as ETH.

5. Look at the pattern of ETH/BTC.

54,52K

The currency circle and the stock market are about to usher in the era of liquidity integration, that is, the era of currency stocks, which will be the most glorious moment of the currency circle.

The current best assets in the coin stock era are BTC and ETH, and other coins eat the spillover value of both. Because these two assets are enough to be the leader, all compliance channels have been passed. It is easy to operate for listed companies, with enough capacity, and large funds dare to stud.

The top 10 coins by market capitalization may have corresponding treasury strategy companies, and the shares of these treasury companies will rise more than the currency itself.

BTC will reach a "price tipping state" after 2028, that is, usher in an accelerated rally.

The real cottage season is not yet coming, you can rest assured that stud.

9,12K

Pumpfun TGE will be another harvest of on-market liquidity, with $600 million in direct fundraising and more than $1 billion in selling pressure, which is as lethal as $trump at the moment.

Remember what happened after $trump? SOL went all the way down, the cabal accelerated the harvest, and the small coins began to fall off a cliff.

If I were the pumpfun team, I would also choose the last cash-out, billions of market capitalization plates, such a high liquidity rate, it must be realized first, -95% of the bubble is eliminated and then consider whether to operate the second time.

11,91K

To summarize the content that friends have been chatting about the most recently:

1. There is no alpha in the currency circle, and beta is not as good as U.S. stocks

2. At present, it is the last grassroots cycle in the currency circle, and those who have not made money should hurry, and those who have made money before have held on

3. Compliance is a general trend, but it can't make money in the short term

4. BTC is the only big narrative in the cryptocurrency circle

5. ETH fundamentals seem to have not changed but have actually changed, so it will rebound but it is difficult to reverse (I will write a special article to analyze it in the future)

7,7K

The currency circle is really bearish, not about the price, but about the vitality of the industry. It's been a long time since you've felt real excitement

The new project is either a narrative to CEX or to VC, what are the projects of the big firm in the past year? MEME projects account for 1/3, intrapreneurship accounts for 1/3, and institutional shipment projects account for 1/3.

And this new product next door, first of all, is a DeFi, there is no hierarchical CX, the bottom layer is a stablecoin, and the minting mechanism is similar to DAI, but there is a bullish circular rebate mechanism, which can be done 10 times in 100 days, and the key is really not to use the principal to pay for waves...

I would like to call it stablecoin 4.0, if you focus on consumption and transfer scenarios, this mechanism is really unsolvable, if it is 1 to 1 copy to the chain, at least it is a $1 billion TVL + $10 billion FDV stablecoin project.

29,9K

Recently, I got to know a big Ponzi group that has lasted for 20 years. Their economic model directly opened up the second pulse of Ren Du for me, just like when Xuzhu was empowered by Wuyazi. The economic model of the currency circle is simply equal to nothing compared to them.

And the most awesome thing is that they have avoided legal risks, the latest project has a deposit of more than 50 million US dollars in 2 months, there are already more than 10 million real users, more than a dozen ecological subsidiaries...

42,29K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin