Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Ariah Klages-Mundt

🏗️ 🧑🔬 @GyroStable. Decentralized finance, applied math, network science. Prev: PhD @Cornell, analytics MBS/ETFs/indices.

Ariah Klages-Mundt kirjasi uudelleen

Dynamic CLPs are one of the safest dynamic pool designs while sporting the best markouts (real yield) on the market.

ALMs on Uni/Aero are complicated integrations and have led to many exploits.

Vs E-CLPs build in a very simple way of shifting the pool itself.

2,55K

When are LP APYs 'real'? Markouts is a very interpretable tool to help answer!

Gyroscope's Dynamic E-CLP gained 4.5% last month in markouts, which is a direct trading PnL vs the market.

That's 69% annualized (compounded), which for this pool explains most swap APYs.

In contrast, beware of pools where markouts are much less (or negative!) than swap APYs. Those are pools where LPs will likely get rekt.

Ariah Klages-Mundt11.7. klo 01.47

You also have to know what you're doing to achieve it.

Gyroscope's pools are the only ones we're aware of that generate consistently high *positive* trading PnL for LPs. Most other pools in aggregate are negative.

Cherry on top that Gyroscope's pools are completely passive.

3,11K

Dynamic CLPs are doing amazing stats for the crypto majors (ETH and BTC pairs) and will keep scaling.

But where is the next 1000x liquidity opportunity?

Onchain currency markets (forex). Dynamic CLPs were designed for this.

- FX volumes $2T/day >> $8B/day total on DEXs today

- FX penetration onchain is tiny today, only 0.0005%. Bringing just 1% onchain would grow the pie of total DEX markets today by 2.5x -- plenty of room for Gyroscope to grow into.

FX markets are the most liquid markets in the world but at the same time some of the least competitive for consumers to access. You can trade SPY/USD for 1 cent spread (< 1bp), but typical EUR/USD trades cost 50-300bp for consumers.

If the volume routes onchain, onchain LPs can outcompete this. In addition to democratising access to liquidity provision, stablecoins can also offer more efficient settlement structures in at least some use cases.

While onchain FX has been tried before, there's never been a better opportunity than now:

- Stablecoin rails are being adopted already by TradFi

- Coinbase, Binance, Kraken etc are bootstrapping activity on their own chains with a vested interest and fintech connections that could port offchain volumes onchain

E.g., new products could bundle USD <> USDC <> EURC <> EUR in a seamless offchain experience but using onchain liquidity under the hood to outcompete consumer alternatives like Wise.

Gyroscope is in a good position to grow with this and help facilitate it when it happens: Gyroscope's CLP tech is proven, in production, and already demonstrating its profitability for liquidity providers.

Gyroscope14.7. klo 23.47

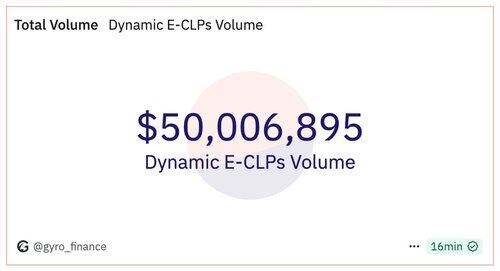

Dynamic E-CLPs have surpassed $50M in volume and $140K swap fees in just a month.

On pools demonstrating the best performance for LPs, measured by markouts.

1,73K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin