Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

PANews

PANews reported on July 20 that according to The block, a letter signed by two senior financial officials in El Salvador stated that the country has never purchased any Bitcoin since signing a financing agreement with the International Monetary Fund (IMF) in February 2025. This is in stark contrast to statements made by the country's president, Nayib Bukel, and his Bitcoin office. The letter was part of the IMF's first project review on July 15, which stated that "the amount of Bitcoin held by the public sector remains unchanged." The attached document states that El Salvador has provided the addresses of all hot and cold wallets to the IMF for review and monitoring.

However, since President Bakele announced this move in November 2022, his government has repeatedly claimed to buy 1 Bitcoin per day. The country's Bitcoin office claims that the country's Bitcoin reserves are about 6,242 Bitcoins (BTC), worth about $737 million. Blockchain intelligence firm Arkham supports daily transfers of 1 Bitcoin, primarily from addresses labeled as Binance or Bitfinex hot wallets.

President Bukele has previously said that it will not stop buying Bitcoin despite the International Monetary Fund's (IMF) agreement providing El Salvador with a $1.4 billion loan requiring the country to reduce Bitcoin activity.

1,17K

PANews reported on July 19 that according to Caixin, Guan Tao, global chief economist of Bank of China Securities, said at a recent online seminar at the China Macroeconomic Forum (CMF) that the US dollar stablecoin is not the legal currency of the United States, lacks the protection of sovereign credit, and can adopt a "wait-and-see" attitude towards stablecoins. Guan Tao believes that China actually already has formal "stablecoin-like" assets. For example, the Hong Kong dollar is issued by three local banknote issuers according to the rule of the 1 US dollar:7.8 Hong Kong dollar system, but unlike many stablecoins, even the Hong Kong dollar issued by different note-issuing houses is interoperable and undifferentiated. In addition, the customer funds of third-party payments such as WeChat and Alipay are fully entrusted to the People's Bank of China, which is also similar to the issuance of 1:1 stablecoins, and in reality, RMB is still used for payment and settlement.

Guan Tao further pointed out that as fiat-linked stablecoins are increasingly regarded as "fiat currencies" and included in regulation, their original advantages will actually be weakened. If stablecoins are regarded as real money, then currency, as a general equivalent, will inevitably move towards oligopoly, and most stablecoin issuers will find it difficult to survive or make money.

9,57K

PANews reported on July 19 that the Trump family crypto project WLFI posted a post on the X platform to clarify community doubts, stating that the tokens of any co-founders, teams or advisors will not be unlocked when they are launched, and WLFI has been committed to fairness and trust-building since day one. WLFI will not launch a new presale, but will partner with mainstream exchanges to create a WLFI rewards program that allows earnings on existing platforms that are used and trusted, a new way for everyone to join the free movement.

194

PANews reported on July 19 that Bitdeer, a Nasdaq-listed Bitcoin mining company, released the latest data on its Bitcoin holdings on the X platform, and as of July 18, its total Bitcoin holdings have increased to 1,601.4 (Note: This amount is pure holdings and does not include Bitcoin deposited by customers). Bitdeer also said that its Bitcoin mining output was 65.0 BTC this week, but it sold 27.4 BTC.

215,01K

PANews reported on July 19 that according to Hong Kong media reports, after the listing of Bitcoin ETFs in Hong Kong, Ren Junfei, founder and CEO of Pandu, a licensed virtual asset management company, announced that it intends to launch a pledged spot Ethereum ETF product in Hong Kong in the second half of this year.

394,44K

PANews reported on July 19 that as the Fed is about to enter a quiet period, incumbent Governor Waller, a popular candidate for the next Fed chairman, reiterated his support for a 25 basis point rate cut in July, and data showed that consumer expectations for inflation have improved. At the same time, trade tensions between the United States and the EU continue, with Trump pushing for a minimum tariff of 15%-20% on all EU goods and planning to announce industry-specific tariff plans by August 1. In addition, the twists and turns of "cryptocurrency week" came to a perfect end after Trump signed the stablecoin bill as scheduled. Bitcoin hit a new all-time high of more than $123,000 this week, and Ethereum stood above $3,600 on Friday, outperforming Bitcoin for the fourth consecutive week. Here are the key points that the market will focus on in the new week:

At 22:00 on Monday, the monthly rate of the leading indicator of the US Chamber of Commerce for June

At 20:30 on Tuesday, Federal Reserve Chairman Powell delivered a welcome speech at a regulatory meeting;

At 1:00 on Wednesday, Fed Governor Bowman hosted a fireside chat session at the Fed-hosted Major Bank Capital Framework Conference;

On Wednesday, US President Donald Trump spoke at an event called "Winning the AI Race";

Thursday 20:30, US initial jobless claims for the week to July 19;

For the US, price and employment sub-indicators may cause additional attention. Analysts at ABN Amro believe that "as the final shape of the U.S. tariff regime remains undecided, the recent moderate inflation trend clearly does not help reduce uncertainty about the final impact of Trump's trade policy on inflation." ”

680,32K

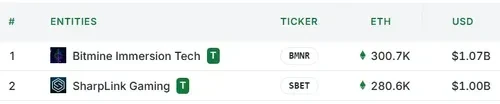

PANews reported on July 19 that according to Strategic ETH Reserve data, Nasdaq-listed SharpLink Gaming's Ethereum holdings have reached $1 billion (about 280,600 ETH), becoming the second U.S. listed company with Ethereum holdings worth $1 billion, second only to Bitmine Immersion Tech. The latter currently holds about 300,700 Ethereum coins, worth about $1.07 billion.

In addition, the total amount of ETH held by the leading institution with more than 100 ETH in Ethereum reserves has increased to about 1.8 million, worth about $6.29 billion.

11,42K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin