Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

qinbafrank

Investor in Crypto, TMT, AI, tracking the most cutting-edge technology trends, wild macro political and economic observation, researching global capital liquidity, cyclical trend investment. Record personal learning and thinking, often make mistakes, and fall into the pit and climb the pit normally. Runner🏃

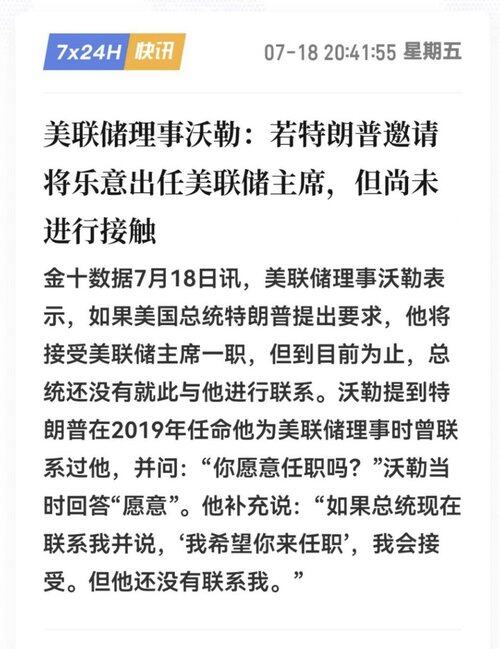

"Waller, bro, I've been so proactive and ambitious, can't you see that? Why haven't you come to chat with me yet? I'm feeling sad!"

qinbafrank20.6.2025

Waller wants to improve so much that Trump said: "This old boy can handle it, the next FED president will be the first choice"

21,48K

In the twentieth episode, let's chat with Brother Ni @Phyrex_Ni and Steven @Trader_S18 about the current market, macroeconomics, the cryptocurrency market, and the US stock market.

FLAME LABS18.7. klo 19.06

Hello old friends, it's been a long time, and I miss you all. 🥰😘

I believe everyone is very concerned about where Bitcoin, Ethereum, and the U.S. stock market will go after reaching new highs?

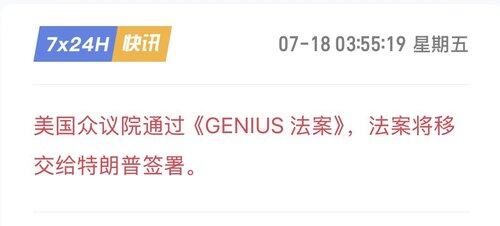

This week is Crypto Week, and there will be three important crypto bills passed, which could even fundamentally change the infrastructure of the crypto space. After these fundamental changes, how should we proceed in the future?

Trump has been frequently pressuring Powell by using the renovation of the Federal Reserve headquarters as a breakthrough point, and his fate has attracted global capital attention.

As a barometer, the Federal Reserve Chair plays a key role in guiding when interest rates will be cut.

How will Trump conduct the next round of the tariff war on August 1st, two weeks from now?

There are so many questions lingering in our minds, so instead of waiting for a better day, let's meet tonight at 8:30 with old partners @Phyrex_Ni @qinbafrank @Trader_S18 for a reunion 🤝 and discuss recent hot topics in "Let's Talk"~🙌

14,61K

Last year, this tweet discussed how the "artificial intelligence and cryptocurrency" industry in the Trump era must take on the same historical mission as the "information superhighway" of the Clinton era and the "Star Wars program" of the Reagan era. At that time, many people did not understand, but through the stablecoin legislation, they are likely to truly grasp their intentions.

qinbafrank17.7. klo 20.39

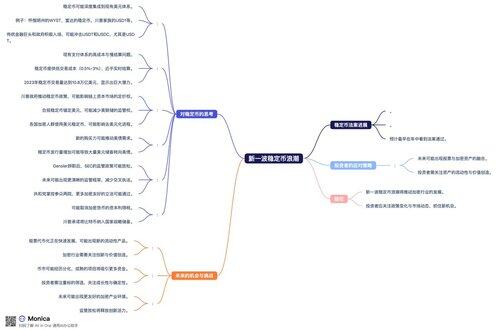

Understanding and iteration of the stablecoin bill, the integration of cryptocurrencies and stocks, and the development of the crypto industry. Thanks to mercy for bringing this up, it's a good opportunity to sort through past tweets.

1. Related to stablecoins

1) 20250327 A new wave of stablecoins is coming

2) 20250605 The stablecoin bill finds new purchasing power for US Treasuries, but it does not equate to debt reduction.

3) 20250621 The valuation logic of Circle

2. Deregulation and the integration of cryptocurrencies and stocks

1) 20241116 Outlook on US crypto industry policy during Trump's new term: "A future-friendly environment that encourages innovation in the crypto industry and a relaxed regulatory environment for crypto."

2) 20241207 Artificial intelligence and cryptocurrencies must take on the same historical mission as the "Information Superhighway" and "Star Wars" of the past.

3) 20250414 Discussing "deregulation" with the new SEC chairman

4) 20250513 Speech by the new SEC chairman on the trend of integration between cryptocurrencies and stocks

3. Tokenization of stocks and tokenized securities

1) 20250309 Optimistic about US stocks on the blockchain

2) 20250630 The integration and surge of stock tokenization and tokenized securities

3) 20250702 What new assets will emerge under the trend of cryptocurrency and stock integration?

4. Understanding altcoins and the iteration of the crypto industry

1) 20240725 Understanding and iteration of altcoins, how altcoins have developed into what they are today.

2) 20250603 It's time to end the era of crypto foundations.

18,33K

I recommend everyone to take a close look at the key points from SEC Chairman Gary Gensler's speech at the tokenization working group roundtable in May. He mentioned that securities are increasingly migrating from traditional (i.e., "off-chain") databases to blockchain (i.e., "on-chain") ledger systems. On-chain securities also have the potential to reshape various aspects of the securities market, including issuance, trading, holding, and using securities.

The SEC is working to establish a comprehensive regulatory framework for crypto assets, but market participants should not be forced to offshore their blockchain technology innovations. Research into conditional exemption mechanisms should allow new products and services that struggle to launch due to current regulatory constraints the opportunity to innovate under compliance.

48,9K

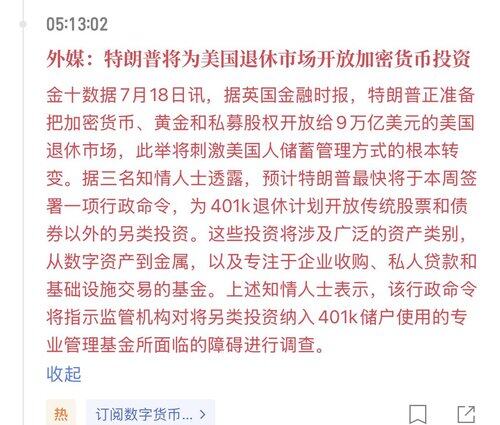

Trump plans to open up crypto assets, gold, and private equity to the U.S. retirement market. The news mentions that the scale of 401(k) retirement plans exceeds $9 trillion, which is just part of the U.S. pension system. Another part is the individual retirement accounts (IRA), which exceed $13 trillion. The total assets related to the U.S. pension system, including 401(k) and IRA, have surpassed $20 trillion. Trump is really getting things done, although he also has his own interests involved.

qinbafrank17.7. klo 20.39

Understanding and iteration of the stablecoin bill, the integration of cryptocurrencies and stocks, and the development of the crypto industry. Thanks to mercy for bringing this up, it's a good opportunity to sort through past tweets.

1. Related to stablecoins

1) 20250327 A new wave of stablecoins is coming

2) 20250605 The stablecoin bill finds new purchasing power for US Treasuries, but it does not equate to debt reduction.

3) 20250621 The valuation logic of Circle

2. Deregulation and the integration of cryptocurrencies and stocks

1) 20241116 Outlook on US crypto industry policy during Trump's new term: "A future-friendly environment that encourages innovation in the crypto industry and a relaxed regulatory environment for crypto."

2) 20241207 Artificial intelligence and cryptocurrencies must take on the same historical mission as the "Information Superhighway" and "Star Wars" of the past.

3) 20250414 Discussing "deregulation" with the new SEC chairman

4) 20250513 Speech by the new SEC chairman on the trend of integration between cryptocurrencies and stocks

3. Tokenization of stocks and tokenized securities

1) 20250309 Optimistic about US stocks on the blockchain

2) 20250630 The integration and surge of stock tokenization and tokenized securities

3) 20250702 What new assets will emerge under the trend of cryptocurrency and stock integration?

4. Understanding altcoins and the iteration of the crypto industry

1) 20240725 Understanding and iteration of altcoins, how altcoins have developed into what they are today.

2) 20250603 It's time to end the era of crypto foundations.

60,74K

Understanding and iteration of the stablecoin bill, the integration of cryptocurrencies and stocks, and the development of the crypto industry. Thanks to mercy for bringing this up, it's a good opportunity to sort through past tweets.

1. Related to stablecoins

1) 20250327 A new wave of stablecoins is coming

2) 20250605 The stablecoin bill finds new purchasing power for US Treasuries, but it does not equate to debt reduction.

3) 20250621 The valuation logic of Circle

2. Deregulation and the integration of cryptocurrencies and stocks

1) 20241116 Outlook on US crypto industry policy during Trump's new term: "A future-friendly environment that encourages innovation in the crypto industry and a relaxed regulatory environment for crypto."

2) 20241207 Artificial intelligence and cryptocurrencies must take on the same historical mission as the "Information Superhighway" and "Star Wars" of the past.

3) 20250414 Discussing "deregulation" with the new SEC chairman

4) 20250513 Speech by the new SEC chairman on the trend of integration between cryptocurrencies and stocks

3. Tokenization of stocks and tokenized securities

1) 20250309 Optimistic about US stocks on the blockchain

2) 20250630 The integration and surge of stock tokenization and tokenized securities

3) 20250702 What new assets will emerge under the trend of cryptocurrency and stock integration?

4. Understanding altcoins and the iteration of the crypto industry

1) 20240725 Understanding and iteration of altcoins, how altcoins have developed into what they are today.

2) 20250603 It's time to end the era of crypto foundations.

Mercy17.7. klo 18.37

"Are stablecoins a conspiracy for the United States? Is the combination of coins and stocks a bigger mass adoption than imagined? Spring is coming for the E Guards?"

Last weekend, I had the pleasure of having the opportunity to interview OG Frank @qinbafrank in the office.

This low-key veteran investor and trader talks about stablecoins and the macro market with clear logic and comprehensive insights. He took me through the decade of consensus on Bitcoin, the American ambitions behind stablecoins, and the future of coin-stock integration.

Frank believes that the crypto market is becoming more efficient, and stablecoins, coin-stock combinations, etc. will force the entire crypto industry to "self-revolution", from bubbles to fundamentals, from narrative to landing. He also did not shy away from pointing out the essential differences between ETH and BTC, as well as the fierce competition for stablecoins in the future.

This is an in-depth interview with a high information density. If you still have questions about stablecoins, RWA, and the recent hot narratives, or are looking for a mental model to understand the new order of the crypto world - this article is recommended for everyone to read carefully!!

👇

153,02K

Thank you, Mercy, for the invitation to discuss the origins of the stablecoin legislation and the "hidden agenda" in the U.S. at OKX's unbeatable seaside office. The new opportunities arising from the trend of merging cryptocurrencies and stocks, the evolution of the U.S. capital markets, and the potential impact of U.S. stocks going on-chain on the future of crypto are all superficial understandings and views. Feel free to criticize 🫡

Mercy17.7. klo 18.37

"Are stablecoins a conspiracy for the United States? Is the combination of coins and stocks a bigger mass adoption than imagined? Spring is coming for the E Guards?"

Last weekend, I had the pleasure of having the opportunity to interview OG Frank @qinbafrank in the office.

This low-key veteran investor and trader talks about stablecoins and the macro market with clear logic and comprehensive insights. He took me through the decade of consensus on Bitcoin, the American ambitions behind stablecoins, and the future of coin-stock integration.

Frank believes that the crypto market is becoming more efficient, and stablecoins, coin-stock combinations, etc. will force the entire crypto industry to "self-revolution", from bubbles to fundamentals, from narrative to landing. He also did not shy away from pointing out the essential differences between ETH and BTC, as well as the fierce competition for stablecoins in the future.

This is an in-depth interview with a high information density. If you still have questions about stablecoins, RWA, and the recent hot narratives, or are looking for a mental model to understand the new order of the crypto world - this article is recommended for everyone to read carefully!!

👇

13,3K

Regarding Trump's attempt to fire Powell last night, as previously stated: firing Powell without cause actually undermines the independence granted to the Federal Reserve by U.S. law (challenging the constitutional system); whether it's calling out Powell or pushing Federal Reserve board members to come out against him in support of interest rate cuts, or discussing the early determination of the next Federal Reserve chair, or trying to force Powell to resign by overspending on renovations of the Federal Reserve building, all of this is political maneuvering within the framework of constitutional law. Firing Powell is not the optimal choice; getting Powell to resign voluntarily is.

In the next ten months or so, Powell may: 1) resign voluntarily; 2) serve until the end of his term but Trump nominates a chair candidate early; 3) be fired. For Trump, the best scenario is naturally 1), the second best is 2), and currently, the market is more focused on the interest rate policy path after the new chair takes office. Of course, if it's 3), it will still cause some impact, but the intensity should not be significant.

83,31K

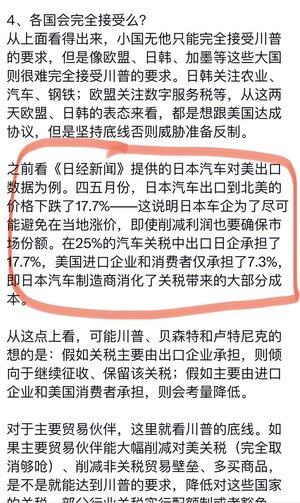

The recently released U.S. June PPI data all fell short of expectations and were lower than previous values, especially with the PPI and core PPI month-on-month rates both at 0%, significantly below expectations. As the price index at the wholesale level, PPI serves as an upstream indicator for inflation data like CPI and PCE, suggesting that the June PCE data should be quite good, and it even provides a leading indication for July's inflation data. This is positive data for the market. The day before yesterday, I mentioned that "greed is harder to reverse than fear," which undoubtedly boosts market sentiment and future interest rate cut expectations.

The PPI (Producer Price Index) has significantly decreased across the board from producers to wholesalers, showing no reflection of tariff impacts. I believe there are two reasons for this:

1. Today’s tweet on "What does Trump really want regarding tariffs?"

2. The weakness in the service sector; the June PPI data falling short of expectations is largely due to the decline in service sector prices. Yesterday's CPI data also showed that the core CPI month-on-month was below expectations.

qinbafrank15.7. klo 20.59

The recently released U.S. June CPI data shows that overall inflation is higher than the previous value but meets expectations, while the core CPI month-on-month is lower than expected. The Cleveland Fed's inflation forecast is very close to the actual published data. What do you think? The inflation data is higher than the previous value, but not higher than expected, which has an impact on the market but should not be too significant. It will slightly weaken momentum but has not reached the point of reversal. In the current market sentiment, it may be viewed as a one-time rebound. The slight drop in the ten-year U.S. Treasury yield after the data was released also indicates that the bond market sees the 0.2% month-on-month core CPI as favorable for interest rate cuts.

As mentioned last night, "Greed is always harder to reverse than fear."

34,77K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin