Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

BurstingBagel 🥯

Delusional crypto optimist | Occasional long form content

Flashblocks makes base lightning fast. 200ms confirmation times makes transactions feel instant. I recommend trying it for yourself by buying smth on Flaunch. Fwiw, I think a rotation from Solana to Base is likely if SOL continues to underperform. Full disclosure: I own $FLAY

ƒlaunch17.7. klo 08.03

Flaunch just got 10x faster ⚡

Flashblocks are live, and Flaunch has day 1 support 🔥

3,17K

I debated building an app for csgo collectors to borrow against their skins in a p2p style fashion using crypto rails. The total csgo item marketcap is 5 billion +, making it one of the largest in game economies and a bigger market than all pfp collections combined. Never went through with the idea because the centralized nature of how steam operates. They can ban your account whenever they want and they’re known for their terrible customer support. In fact, just yesterday they implemented a feature that allows you to reverse item trades made in a 7 day window.

1,22K

Everyone knows these crypto treasury companies are going to unravel one day but will cheer them on because they're buying our bags. That's fine, but your future self is begging you to spend some time understanding the inner workings today so you can be prepared when things go south.

Study Luna

Study GBTC

Study Thorchain

2,86K

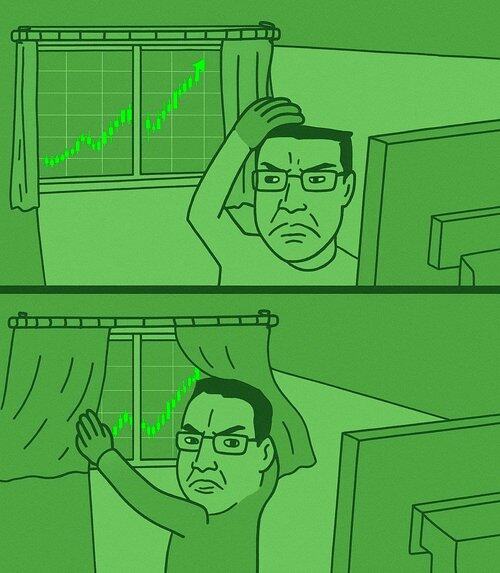

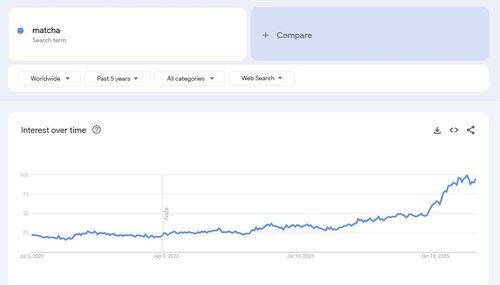

Been spending time looking for new potential investable trends outside of crypto in the last few days:

1. Matcha. Sales of matcha have increased significantly worldwide over the last year. I wasn't able to find a publicly traded equity that offers good exposure to the trend. There's Starbucks, but I don't think the trend is enough to move the needle.

2. Natural food dyes. HHS is forcing US food companies to remove artificial food dyes from their products. Producers of food coloring with a large % of revenue coming from natural food dye stand to benefit the most. $SXT (Sensient Technologies Corporation) is up 50% since the announcement on April 22nd from HHS to phase out synthetic food dyes.

3. "College is a scam". Many Americans nowadays are questioning whether college is worth the cost. The fact that this is a topic of debate indicates a shift is underway. I believe this sentiment will only worsen as self-taught AI tutoring solutions are introduced and AI begins to replace white-collar jobs. For the first time, college graduate unemployment rates are higher than those of the general population. You could short Sallie Mae (SLM), which offers private student loans. This would be a bet on higher default rates + fewer people taking out student loans.

What trends have you picked up on? It could be a product you recently bought or got rid of, something you've seen all over social media...

2,98K

Been spending time looking for new potential investable trends outside of crypto in the last few days:

1. Matcha. Sales of matcha have increased significantly worldwide over the last year. I wasn't able to find a publicly traded equity that offers good exposure to the trend. There's Starbucks, but I don't think the trend is enough to move the needle.

2. Natural food dyes. HHS is forcing US food companies to remove artificial food dyes from their products. Producers of food coloring with a large % of revenue coming from natural food dye stand to benefit the most. $SXT (Sensient Technologies Corporation) is up 50% since the announcement on April 22nd from HHS to phase out synthetic food dyes.

3. "College is a scam". Many Americans nowadays are questioning whether college is worth the cost. The fact that this is a topic of debate indicates a shift is underway. I believe this sentiment will only worsen as self-taught AI tutoring solutions are introduced and AI begins to replace white-collar jobs. For the first time, college graduate unemployment rates are higher than those of the general population. You could short Sallie Mae (SLM), which offers private student loans. This would be a bet on higher default rates + fewer people taking out student loans.

What trends have you picked up on? It could be a product you recently bought or got rid of, something you've seen all over social media...

850

One of the most underrated advantages in life is learning to shift from a consumer mindset to an investor mindset. Just look around. Almost everything you interact with is a product sold by one person to another. If you train yourself to notice what people are using, talking about, or obsessed with, you can often spot trends before sophisticated investors have time to connect the dots.

Here are a few personal examples:

$NVDA: When ChatGPT first launched, I was still in college. It felt like a total cheat code for assignments and clearly marked a paradigm shift. Everyone was talking about it yet it never crossed my mind to ask who benefits most from this. NVIDIA is now up nearly 10x since then.

$RBLX: My roommate got into Roblox and kept telling me about the crazy player numbers and how massive it was with younger audiences. I couldn’t understand the appeal. It felt like pure brain rot. But that didn’t matter. Roblox stock has appreciated by nearly 3x in the past year.

$CELH: I ran out of pre-workout and started drinking Celsius instead before my lifts. Not long after $CELH doubled.

Pay attention.

2,07K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin