Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

DMH 🦇🔊🌊

@0xfluid / @Instadapp | COO new tg: @iam_dmh The approach is not to limit the choice, but to provide a broader choice.

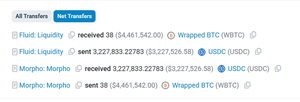

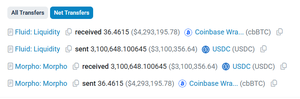

User migrated ~$9m wBTC and cbBTC from Morpho to Fluid

Makes a lot of sense, as Fluid offers the highest liquidation threshold in the industry at 90%, along with currently lower borrowing rates.

Fluid 🌊22.6.2025

Fluid offers the highest Liquidation Thresholds and lowest Liquidation Penalties in the industry.

With a 92% LT on ETH and 90% LT on BTC, you're better protected against extreme market volatility.

Migrate now: 🌊

8,74K

DMH 🦇🔊🌊 kirjasi uudelleen

Fluid vs Uniswap || Which One Uses Liquidity Better?

I'm really interested in Fluid's innovative approach, so I wanted to check for myself how efficient its liquidity actually is compared to Uniswap.

To make the comparison fair, I looked at the weETH-ETH pool on both platforms, since their average TVL over the past 30 days was roughly the same:

▪️$19.4M for Fluid

▪️$20.7M for Uniswap V3

You’d think Uniswap would perform better, since it had slightly more TVL on average over the same period...

Spoiler, not at all 👇

2,22K

DMH 🦇🔊🌊 kirjasi uudelleen

Fluid vs Uniswap

On 30 days time frame Fluid is doing 1/3rd of Uniswap volume.

On 7 days time frame Fluid is doing half of Uniswap Volume .

On 24 Hours Fluid is doing more than 50% of uniswap volume .

Do you see the pattern here , Can you guess the future where we are headed ?

Fluid will flip uniswap before the end of the year with buybacks coming soon .

$FLUID undervalued here .

9,06K

DMH 🦇🔊🌊 kirjasi uudelleen

It's not hard to see the loans (smart debt) becoming the deepest AMM pools in the long run.

A lot more demand for borrowing than for pure DEX LP-ing.

Total *stablecoin* borrow amount on major DeFi lending protocols on Mainnet is hitting ATH each day and is now over $11b.

Currently below 2% of this stablecoin debt is utilized as trading liquidity.

This is actually why I believe combining lending with DEXs is going to win, not just because of trading fees effecntively lowering borrow rates, but even more due to enabling significantly lower price impacts for onchain swaps.

Note: Same assumption goes for non-stable debt.

10,65K

DMH 🦇🔊🌊 kirjasi uudelleen

Bit of alpha about $FLUID:

First time they hit 1B in volume ever. Now imagine when Ethereum onchain will ramp up in the next few months and v2 ''coincidently'' allows volatile pairs to be used as LP for smart collateral (and not just stables or wbtc, which is where most of the volume comes from).

You do the math. Big odds it will take over Uniswap after v2 in volume.

22,98K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin