Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

jeff.hl

@hyperliquidx building a pretty good L1

Why transparent trading improves execution for whales

Throughout Hyperliquid’s growth, skeptics questioned the platform's ability to scale liquidity. These concerns have been resolved now that Hyperliquid is one of the most liquid venues globally. With Hyperliquid’s adoption by some of the largest traders in crypto, discussion has shifted to concerns around transparent trading. Many believe that whales on Hyperliquid are:

1) frontrun as they enter their position

2) hunted because their liquidation and stop prices are public

These concerns are natural, but the opposite is actually true: for most whales, transparent trading improves execution compared to private venues.

The high level argument is that markets are efficient machines that convert information into fair prices and liquidity. By trading publicly on Hyperliquid, whales give market makers more opportunity to provide liquidity to their flow, resulting in better execution. Billion dollar positions can have better execution on Hyperliquid than on centralized exchanges.

This post covers a complex line of reasoning, so it may be more compelling to start with a real-world example from tradfi to demonstrate this universal principle. After all, actions speak louder than words.

Example

Consider the largest tradfi ETFs in the world that need to rebalance daily. Examples include leveraged ETFs that increase positions when prices move favorably and decrease positions in the other direction. These funds manage hundreds of billions of dollars in AUM. Many of these funds choose to execute on the closing auction of the exchanges. In many ways this is a more extreme version of whales trading publicly on Hyperliquid:

1. These funds’ positions are known almost exactly by the public. This is true on Hyperliquid as well.

2. These funds follow a precise strategy that is public. This is not true on Hyperliquid. Whales can trade however they want.

3. These funds trade predictably every day, often in massive size. This is not true on Hyperliquid. Whales can trade whenever they want.

4. The closing auction gives ample opportunity for other participants to react to the ETFs’ flows. This is not true on Hyperliquid, where trading is continuous and immediate.

Despite these points, these ETF managers opt into a Hyperliquid-like transparency. These funds have full flexibility to make their flows private, but proactively choose to broadcast their intentions and trades. Why?

History of transparency in electronic markets

A complementary example is the history of electronic markets. As summarized above, markets are efficient machines that convert information into fair prices and liquidity. In particular, electronic trading was a step-function innovation for financial markets in the early 2000s. Prior trading occurred largely in trading pits, where execution quality was often inconsistent and spreads wider. With the advent of programmatic matching engines transparently enforcing price-time priority, spreads compressed and liquidity improved for end users. Public order books allowed market forces to incorporate supply and demand information into fairer prices and deeper liquidity.

The spectrum of information

Order books are classified by their information granularity. Note that L0 and L4 are not standard terminology, but are included here as natural extensions of the spectrum.

L0: No book information (e.g. dark pools)

L1: Best bid and offer

L2: Levels of the book with price, total size of level, and optionally number of orders in the level

L3: Individual anonymized orders with time, price and size. Some fields including sender are private

L4 (Hyperliquid): Individual orders with complete parity between private and public information

Each new level of order book granularity offers dramatically improved information for participants to incorporate into their models. Tradfi venues stop at L3, but Hyperliquid advances to L4. Part of this is necessity, as blockchains are transparent and verifiable by nature. However, I argue that this is a feature, not a bug.

Zooming out, the tradeoff between privacy and market efficiency spans the full spectrum from L0 to L4 books. On this scale, L3 books can be viewed as an arbitrary compromise, not necessarily optimal. The main argument against L4 books is that some strategy operators prefer privacy. Perhaps there is some alpha in the strategy that is revealed by the order placement. However, it’s easy to underestimate the sheer talent and effort going into the industry of quantitative finance, which backs out much of these flows despite anonymized data. It’s difficult to enter a substantial position over time without leaking that information to sophisticated participants.

As an aside, I believe financial privacy should be an individual right. I look forward to blockchains implementing privacy primitives in a thoughtful way in the coming years. However, it's important not to conflate privacy and execution. Rather than hand-in-hand concepts, they are independently important concepts that can be at odds.

How market makers react to information

One might argue that some privacy is still strictly beneficial. But privacy is far from free due to its tradeoff with execution: toxic flow can commingle with non-toxic taker flow, worsening execution for all participants. Toxic flow can be defined as trades where one side immediately regrets making the trade, where the timescale of "immediate" defines the timescale of the toxicity. One common example is sophisticated takers who have the fastest line of communication between two venues running toxic arbitrage taker strategies. Market makers lose money providing liquidity to these actors.

The main job of a market maker is to provide liquidity to non-toxic flow while avoiding toxic flow as much as possible. On transparent venues, market makers can categorize participants by toxicity and selectively size up to provide as a non-toxic participant executes. As a result, a whale can quickly scale into a large position faster than on anonymized venues.

Summary

Finally returning to the example of ETF rebalancing, I imagine the conclusion of rigorous experimentation confirmed the points above. Addressing the specific subpoints in the introduction:

1) A transparent venue does not lead to more frontrunning than private venues. Rather, traders with consistently negative short term markouts benefit by broadcasting their autocorrelated flow directly to the market. Transparent venues offer a provable way for every user to benefit from this feature.

2) Liquidations and stops are not “hunted” on transparent venues more than on private venues. Attempts to push the price on a transparent venue are met with counterparties more confident to take the mean reversion trade.

If a trader wants to trade massive size, one of the best things to do is tell the world beforehand. Though counterintuitive, the more information that is out there, the better the execution. On Hyperliquid, these transparent labels exist at the protocol level for every order. This enables a unique opportunity to scale liquidity and execution for traders of all sizes.

798,71K

Excited to see the world's most popular stablecoin on Hyperliquid!

Enabling permissionless and fully customizable multi-chain assets was one of the key motivations for the HyperEVM. It's great to see the USDT0 and LayerZero teams provide a seamless and secure product for all Hyperliquid users.

Users can mint USDT0 from various source chains without needing to make a pit-stop on a required chain before bridging. Indeed, USDT0 is secured by the LayerZero protocol without need for a custom smart contract bridge.

From the builder's perspective, USDT0 highlights the power of the HyperEVM as a general-purpose interface into the entire Hyperliquid blockchain. USDT0 plugs into the HyperEVM as another EVM chain in its multichain network. The magic is that once the ERC20 tokens are minted on the HyperEVM, they are seamlessly composable with HyperCore without ever leaving Hyperliquid.

As HyperCore features expand to multiple collateral assets, they will apply to USDT0 as a first-class spot asset on HyperCore. At the end of the day, users get the best of both worlds: functionality on the full suite of Hyperliquid features and a secure, battle-tested omnichain onramp experience.

USDT09.5.2025

USDT0 is live on @HyperliquidX Spot and HyperEVM.

Liquidity of the largest stablecoin in the world powering the blockchain to house all finance.

Your USDT, now on Hyperliquid.

280,16K

Thanks for having me on lads! Enjoyed the conversation

Hyperliquid

Steady Lads5.4.2025

The Lads are hyped for @chameleon_jeff to join for Episode #89 and discuss all things @HyperliquidX 🫡

🚨 OUT NOW on @YouTube & @Spotify!

In this Ep we cover:

🎵 Trump Tariffs & The Market

🏗️ The Greater Vision for Hyperliquid

⁉️ What Happened w/ JELLY?

😱 Are CEXs Threatened?

🍝 Pasta of the Week and More!

Full links below!👇

58,99K

Reminder: the Hyperliquid dev team does not profit from increased activity as it does not collect trading fees. On the contrary, it is entirely self-funded with exponentially increasing burn. There is not a single private investor.

>$25M of revenue has gone back to the community through HLP. Another project could have easily pocketed some or all of these profits.

What’s the point of all this? To build something that really matters. When finance moves onchain, it will bring trillions of dollars of value to billions of users. It won’t move for a half-baked system, but the Hyperliquid L1 has a shot.

Some users think that Hyperliquid is already a complete platform. This is flattering, and the Hyperliquid community is indeed one-of-a-kind!

But as someone spending most waking moments pushing Hyperliquid to its full potential, I’m confident that there is a long way to go. In particular, the following are all complex, multi-phase undertakings:

1) deploying the native EVM

2) seamlessly integrating the EVM with existing native components (e.g., order books)

3) fully decentralizing the network

On top of that, the following are continuously being improved:

1) high TPS and low latency L1 with HyperBFT consensus

2) performant financial primitives including fully onchain spot and perp order books, vaults, oracles, automated liquidity and account abstractions

3) state-of-the-art and community-owned order book liquidity via HLP

When you see a 100x, you drop everything to make that a reality. Factors of <2 are insignificant. Big things take time to build, but nothing else is worth building.

393,29K

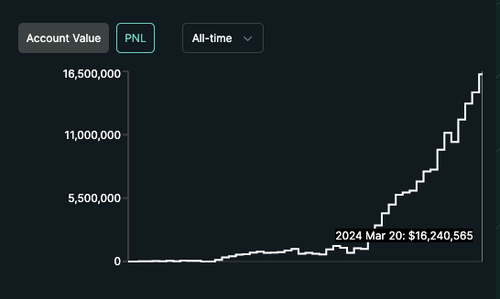

For its ROI and sharpe, HLP is one of the highest capacity strategies in any asset class. And it’s open, transparent, and entirely community owned.

HLP’s alpha is the culmination of tens of thousands of hours thinking deeply about market microstructure.

What’s more, HLP’s primary mandate is to provide deep and tight liquidity. It is not even optimized for pnl.

Conventional wisdom is that quant opportunities are capacity constrained. But @HyperliquidX might be one of the only venues where opportunities are growing faster than capital and mindshare can onboard to capture it.

Look at the top MMs on the leaderboard. Look at HLP. Follow the flow.

41,5K

Latency and tx ordering on @HyperliquidX

Some alpha for MMs and researchers:

1) Hyperliquid L1 has a novel microstructure benefiting retail and makers over toxic takers

2) Volume would be multiples higher without this design

3) Hyperliquid is optimized for the end user, period. Not for VC metrics, fees, or HLP pnl

----

Background

A well-designed exchange matches trades when both sides want to transact. Maximizing volume is a secondary goal. First and foremost buyers and sellers should both be happy with the price. This guiding principle applies to all markets: centralized or decentralized, CLOB/AMM/RFQ etc.

For example, a user market buys on the UI and matches against the maker order with the lowest price. Both sides are happy.

The problem

An order book sometimes satisfies the "well-designed" principle above. If someone has a resting buy order, that means they think the fair price is higher than the limit price, and are happy with a fill.

The major exception is trades between HFT takers and HFT makers. The maker and taker have similar price preferences. Often the maker has sent the cancel request already, but the taker order is slightly faster and picks off the maker. It's no longer win-win. This is why this HFT taker volume is often called "toxic flow."

Toxic flow hurts retail end users the most. Makers will quote wider to minimize collisions with takers. Spreads and liquidity degrade so retail gets worse execution. Everyone is happy except the end user.

Hyperliquid's design

To address this flaw with the standard order book design, Hyperliquid makes a fundamental adjustment to the onchain order book: Cancels and post-only orders are prioritized above GTC and IOC orders.

This ordering is enforced onchain by the L1 itself. The only correct way for a node to execute a block on the Hyperliquid L1 is to sort cancels and post-only orders first.

Hyperliquid has the fastest L1 in production, so human users barely notice this ordering. Most users happily wait half a second to save hundreds of dollars on a trade.

The effects

On Hyperliquid, trades between HFT maker and HFT taker happen at a dramatically lower rate, at least 10x lower than other platforms as a fraction of total volume. Note that this flow is the majority of volume on most other venues.

Liquidity on Hyperliquid becomes deeper and more solid during times of volatility. Retail users get reduced slippage and lower spread on large orders.

Alpha for automated traders

When cancels go through with high success, makers can quote much more confidently.

Takers can still make money aggressing against retail limit orders, or limit orders that actually disagree with the taker's price model.

Hyperliquid's design empowers everyone except those trading against orders that didn't want to be filled to begin with.

Closing thoughts

If Hyperliquid's design is so great, why do no other DEXs or CEXs do it? Because most other venues are not optimized for the end user.

Most platforms instead optimize for some combination of fees and volume metrics. Investors often look at these aggregate stats instead of studying real user experiences.

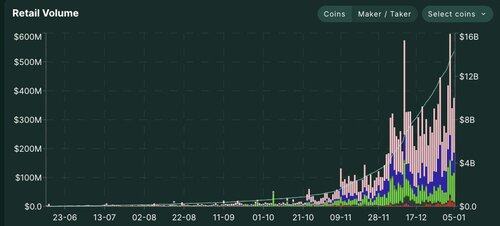

Hyperliquid is solely focused on the end user. Fees and market maker pnl are all increasing exponentially, but this is a byproduct of the relentless focus on the end user.

The stats speak for themselves: On a day where Hyperliquid does $1B in volume, more than $500M is retail.

89,05K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin