Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Matt Hougan

CIO @BitwiseInvest. Co-founder @FutureProof_HQ. Previously CEO @ETFcom. Husband, father, & runner (when I find time).

The giants of finance are telling you something. Position accordingly.

"If it can be tokenized, it will be tokenized." - SEC Chairman Paul Atkins

"Every stock, every bond, every fund - every asset - can be tokenized. And if they are, it will revolutionize investing." - BlackRock CEO Larry Fink

"Tokenization is the biggest innovation in the past decade." - Robinhood CEO Vlad Tenev

155,35K

Folks need to stop making careless comparisons between stablecoins and the “free-banking era” of the 1830s.

In the free-banking era, local banks were able to issue notes in far-flung territories of the United States. They ran into trouble when the notes were backed by weak collateral, like low-grade railroad bonds and remote land bonds.

The system was drastically inefficient, in part because redemptions required you to physically return to the local bank. This meant some notes traded at steep discounts depending on their distance from the issuing point, and merchants needed to maintain giant books of reference pricing across thousands of non-standardized individual notes.

None of these things apply to stablecoins. In the Genius Act, there are strict limits on the assets they hold, redemptions can be made daily from anywhere, and stablecoin prices will trade on exchanges allowing instant convertibility and price discovery. State-regulated stablecoins are size limited ($10b cap), which means they’ll be a vanishing fraction of the market, and are generally subject to the same asset holding and redemption provisions as the federally regulated stablecoins that will make up 95%+ of the market.

I like analogies. They can be helpful in understanding things. But they have to be reasonable. Comparisons to the free-banking era -- which started 188 years ago, when letters moved on horseback and Samuel Morse was still tinkering with the telegraph in the lab -- are not reasonable.

64,83K

Bitcoin will never... w̵o̵r̵k̵

... s̵u̵r̵v̵i̵v̵e̵ ̵a̵ ̵b̵e̵a̵r̵ ̵m̵a̵r̵k̵e̵t̵

... s̵c̵a̵l̵e̵ ̵t̵o̵ ̵h̵a̵n̵d̵l̵e̵ ̵g̵l̵o̵b̵a̵l̵ ̵d̵e̵m̵a̵n̵d̵ ̵

... s̵u̵r̵v̵i̵v̵e̵ ̵a̵ ̵g̵o̵v̵e̵r̵n̵m̵e̵n̵t̵ ̵c̵r̵a̵c̵k̵d̵o̵w̵n̵

... r̵e̵c̵o̵v̵e̵r̵ ̵f̵r̵o̵m̵ ̵M̵t̵.̵ ̵G̵o̵x̵

... s̵u̵r̵p̵a̵s̵s̵ ̵$̵1̵.̵

... s̵u̵r̵p̵a̵s̵s̵ ̵$̵1̵,̵0̵0̵0̵

... s̵u̵r̵p̵a̵s̵s̵ ̵$̵1̵0̵0̵,̵0̵0̵0̵

... g̵e̵t̵ ̵a̵ ̵s̵p̵o̵t̵ ̵E̵T̵F̵

... b̵e̵ ̵o̵w̵n̵e̵d̵ ̵b̵y̵ ̵i̵n̵s̵t̵i̵t̵u̵t̵i̵o̵n̵a̵l̵ ̵i̵n̵v̵e̵s̵t̵o̵r̵s̵

... b̵e̵ ̵h̵e̵l̵d̵ ̵b̵y̵ ̵c̵o̵r̵p̵o̵r̵a̵t̵i̵o̵n̵s̵

... b̵e̵ ̵h̵e̵l̵d̵ ̵b̵y̵ ̵g̵o̵v̵e̵r̵n̵m̵e̵n̵t̵s̵

Keep doubting.

9,6K

Matt Hougan kirjasi uudelleen

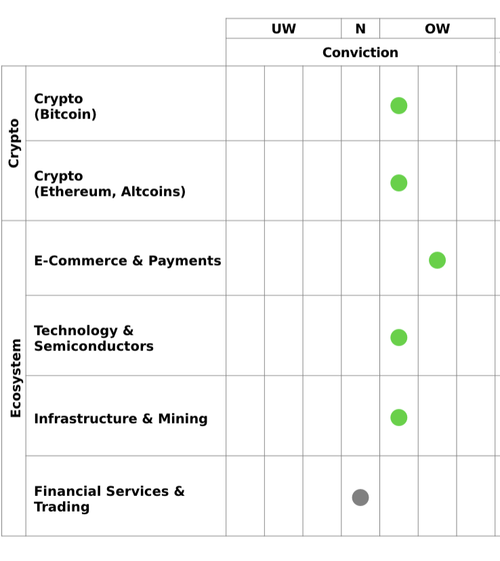

Bitwise signed on to be a strategic advisor to a $50B AUM wealth management firm in the US —

@Matt_Hougan now attends their monthly investment committee meetings and our team helps with analysis.

They just put this out to their advisors:

"The Council reached a strongly bullish consensus on crypto and digital assets, with a compelling case for structural transformation of the financial system."

We're entering the mainstream era.

Advisors are going to help millions of people participate in this asset class.

20,31K

Matt Hougan kirjasi uudelleen

Economically speaking, the main thing that matters going forward is institutional cash flow.

Institutions are much stronger, bigger, more stable, more truly invested hands. Retail is still great for juicy pumps and community building, but institutions are now the floor, and the basis upon which @NEARProtocol as an ecosystem can thrive economically over time.

Amazing job to the Bitwise EU team!

MORE!!!

@markkmii @alex_scharrer @apetrikeev_ @BitwiseInvest @Bitwise_Europe @Matt_Hougan @dgt10011 @HHorsley @BradleyDukeBTC

11,8K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin