Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Litecoin Foundation ⚡️

We're a registered nonprofit dedicated to the growth, development & adoption of @Litecoin | $LTC | Est. 2017

Litecoin Foundation ⚡️ kirjasi uudelleen

Most crypto projects are just tech demos propped up by VC funding.

Litecoin was built differently.

It’s the longest-running, most reliable blockchain alongside Bitcoin.

• 100% uptime

• #1 payments coin

• Trusted by major platforms

• Secure, algorithm dominant

• Commodity-crypto

• Fairly launched

• No insider VC’s that control the supply

• Only 84 million

• User metrics rising vs Bitcoin

7,57K

Exciting news from @LuxxfolioH! After a successful financing round, they have boosted their treasury position in Litecoin by an impressive 151.6% LTC per share since March, totaling 20,084 $LTC!

Luxxfolio Holdings17.7. klo 19.53

🔵🔵🔵🔵🔵🔵🔵🔵🔵🔵🔵🔵🔵

📢 Corporate Update: Luxxfolio has increased our Litecoin treasury to 20,084 LTC — a 151.6% jump in LTC per share since March.

We’ve deployed 841 cbLTC into DeFi to generate on-chain yield and are advancing Litecoin Layer 2 + smart contract development.

$LUXX $LUXFD

🔵🔵🔵🔵🔵🔵🔵🔵🔵🔵🔵🔵🔵

14,36K

Litecoin Foundation ⚡️ kirjasi uudelleen

🚨 IS LITECOIN’S “SILVER TO BITCOIN’S GOLD” NARRATIVE MAKING A COMEBACK?

Litecoin was launched in 2011 by MIT alum Charlie Lee with a clear purpose: to complement Bitcoin, not compete.

From the start, it positioned itself as the “digital silver” to Bitcoin’s gold, with faster block times and lower fees that make it more practical for everyday use.

At the time, most altcoins were flawed experiments — pre-mined, buggy, or outright scams. Litecoin was different. It followed the principles Bitcoin was built on: transparency, openness, and stability.

Charlie Lee launched Litecoin publicly, announced it in advance, and gave the community time to prepare. There was no VC money involved, no pre-sale, and no hidden allocation. The principles of fairness were upheld at all costs.

That kind of transparency is rare in crypto, even today.

Over the years, Litecoin earned a reputation as one of the most secure and resilient networks in the space. It has had 100% uptime since launch and remains the longest-running uninterrupted blockchain. Not even Bitcoin can say that.

Litecoin was built for endurance and reliability, but in a space driven by hype and the “hot new thing,” attention drifted.

The spotlight moved to ICOs, VC-launched coins, Solana memecoins, and whatever trend came next.

Meanwhile, through all the noise, Litecoin kept running, doing its job, mostly unnoticed. Some assumed its time had passed.

But behind the curtain, Litecoin’s user metrics kept climbing. New addresses grew quickly, transactions increased, and the USD value sent over the network continued to rise. Hashrate kept breaking all-time highs. And surprisingly, these metrics began closing the gap with Bitcoin.

Litecoin became the #1 most used crypto on BitPay, outpacing all others — even though it was one of the last to be added. Companies like Bitrefill and CoinGate have published similar metrics: Litecoin consistently ranks among the top coins for real-world spending. People are actually using it, not just holding it.

At the same time, institutions quietly integrated Litecoin into their offerings. Fidelity, Robinhood, PayPal/Venmo, Interactive Brokers, and MoneyGram, to name a few, all support LTC. Not because of speculation, but because it’s a credible and reliable cryptocurrency. Litecoin is also one of the three tickers you typically see on Fox Business TV and other news channels, alongside BTC and ETH. The name recognition is there.

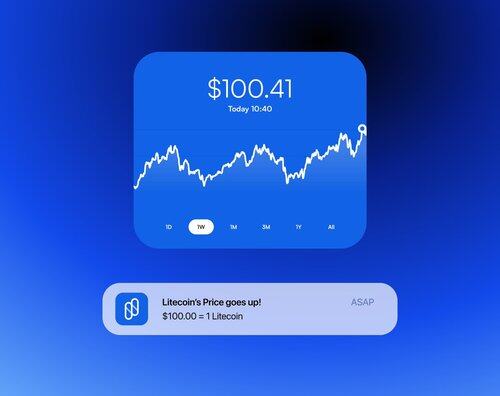

Despite Litecoin’s rising usage and growing institutional support, the market hasn’t fully priced it in. Network activity is climbing, on-chain metrics are breaking records, and Litecoin is outpacing Bitcoin in payment volume on the world's largest crypto payments processor — yet the price action has remained relatively flat. That kind of divergence between utility and valuation doesn’t happen often in this space. For long-term investors, it’s the kind of opportunity that stands out.

And, it’s not just investors who are noticing. Even Bitcoiners who understand infrastructure are re-acknowledging Litecoin’s role in the space, especially after its implementation of MWEB.

Put simply, Litecoin has delivered what most coins can’t:

- 100% uptime

- No pre-mine

- No insiders

- A clean, transparent launch

- Real usage, liquidity, and global recognition thanks to its reliability

Litecoin has also taken the lead in advancing Bitcoin-compatible tech. It implemented SegWit first, which enabled the first-ever Lightning Network transaction to take place on Litecoin. It integrated MimbleWimble Extension Blocks (MWEB), offering users a payments experience that more closely resembles cash. And now, several smart contract platforms are building on Litecoin for the same reasons: security, consistency, and longevity.

People have called Litecoin a “test-bed” for Bitcoin, but that title doesn’t really hold up anymore — especially now that Litecoin’s network metrics are starting to approach Bitcoin’s. As Bitcoin shifts toward being a pure HODL asset and Litecoin continues to be used as actual money, the trend may not just continue, it might flip.

And now, with ETF discussions heating up, Litecoin is gaining fresh attention from institutions — and even companies adding it to their treasuries.

It makes sense. Litecoin structurally resembles Bitcoin: decentralized, no pre-mine, no central issuer. In a regulatory environment increasingly focused on commodities and fair launches, Litecoin stands out.

The silver-to-gold analogy is more relevant than ever.

Every day, it becomes more clear: Bitcoin is the vault. Litecoin is the money — scarce, sound, and actually usable. Together, they serve different purposes in the same sound money ecosystem.

While most networks have dealt with insider dumps, vanished founders, or centralized treasuries, Litecoin has quietly remained decentralized and community-run. It’s already gone through something most projects haven’t — a natural evolution beyond its founder. Charlie Lee remains involved behind the scenes, but the network has never depended on a single figure. Instead of fading, it got stronger. Adoption grew, proving that network effects matter.

Litecoin has been through every kind of hype cycle, and through it all, it just keeps going. It’s still here, standing strong. Developers are looking to build on top of ecosystems that have stood the test of time because they want their work to last. More people are starting to understand this now.

Whether you’re an individual, institution, or builder looking for assets that have survived multiple cycles and still push forward, Litecoin should be on your radar.

“Digital silver” meant durability. And in today’s market, that’s a strength.

12,8K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin