Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

DeSpread

We set the standard to drive web3’s growth and expansion || Web3 growth studio providing data-driven strategy since 2019

[Report] Digital Asset Treasury: From Premium to Multiple

Digital Asset Treasury companies are publicly listed firms that hold digital assets such as Bitcoin as core assets on their balance sheets, while engaging in capital raising and revenue generation. Originating with Strategy, the model has recently expanded to include diverse cases such as Metaplanet and DeFi Development.

• The Archetype of Premium: Strategy’s NAV premium stems from its relatively high accessibility and volatility compared to its underlying assets. Through additional capital raising, it established a financial engineering flywheel that actively capitalizes on this premium.

• Expansion and Differentiation: Metaplanet has adopted a rapid BTC accumulation strategy driven by reliance on specific external capital. Meanwhile, Sol Strategies and DeFi Development have differentiated themselves as operational DATs by monetizing through Solana staking and DeFi integrations.

• Multifaceted Risks: The DAT model contains inherent structural vulnerabilities, including premium collapse (structural risk), dependence on underlying asset prices (market risk), and debt repayment pressure (financial risk). These risks become amplified during bear markets, leading to potential downward spirals.

• Challenges for Sustainability: Mere asset accumulation is only the initial step toward securing working capital for business operations. To build sustainable market presence, DATs must engage in active asset management or develop new business strategies utilizing digital assets. On-chain and off-chain monetization models, along with platform-based businesses, are essential for converting temporary premiums into sustainable market multiples.

The full report "Digital Asset Treasury: From Premium to Multiple" written by @Earl_Senor and @Touslesjours_70 can be accessed through the links below⤵️

ENG:

KOR:

JPN:

2,62K

DeSpread kirjasi uudelleen

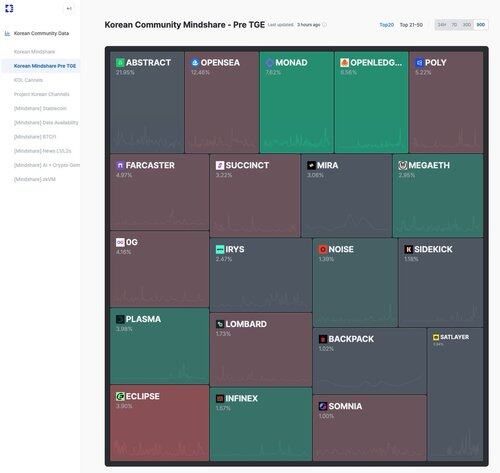

Here's a tip for many projects that no one will tell you:

While Twitter is filled with AI comments and quest-driven noise, the real conversations are happening on Telegram.

In Korea, everything happens on Telegram. Koreans are just using Twitter to farm.

So, refrain from claiming, "we have an amazing Korean community," because the mindshare on X, heavily driven by incentives, is up for a few weeks.

Double down on where real conversations are happening.

2,84K

DeSpread kirjasi uudelleen

For the first time since our legal victory in the Seoul High Court and Supreme Court, our leadership team will be heading to Seoul, Korea as a part of Sonic's Asia expansion.

Join the team @michaelfkong @SjHarcourt @SonicAssistant @seasun0x @miumiuqin on July 17th to learn more about Sonic's technology and community. @DeSpreadTeam @FACTBLOCK @Coiniseasy.

서울에서 소닉랩스를 만나보세요:

41,46K

Meet the engine of Programmable Liquidity here

Mitosis26.6.2025

Calling all Mitosis friends in Seoul 🇰🇷

We're hosting an exclusive local meetup in Korea, alongside @DeSpreadTeam and @SpindleAG!

Wen: 7 PM KST on July 2nd

Check the full details and book your seat in advance ⬇

282

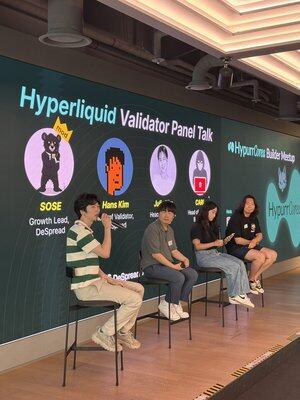

Amazing turnout at the HypurrCorea: @HyperliquidX Builder Meetup!

Loved exploring the Hyperliquid Ecosystem and the innovative projects on HyperEVM.

HypurrCorea

Hyperliquid

SKYGG20.6.2025

Thank you to everyone who joined the HypurrCorea: @HyperliquidX Builder Meetup!

We were genuinely surprised and grateful for the amazing turnout for a builder-focused event held in the afternoon and evening hours.

Special thanks to our co-hosts and sponsors, @DeSpreadTeam x @SKYGG_Official,

and to our supporting sponsors, @Hyperliquid_KR and @ottionhl, for making it all possible.

493

[Report] A Strategic Framework for the Coexistence of the Three Pillars of Digital Currency

This report aims to analyze the global issuance and circulation mechanisms of digital assets that claim to function as legal tender, and to propose regulatory directions and growth strategies that should be adopted by Korean policymakers and industry stakeholders. Readers in other jurisdictions are encouraged to interpret the findings within the context of their own regulatory environments.

Key Points

- CBDCs and stablecoins are not substitutes but complements, reflecting the traditional dual structure of central bank money and commercial bank money in a digital context.

- Bank-issued stablecoins are optimized for wholesale settlement and institutional trust, while non-bank stablecoins serve retail economies and Web3 ecosystems—together forming a parallel framework.

- As demonstrated by initiatives like Project Agorá, CBDCs are essential for cross-border settlement due to their legal finality, protection of monetary sovereignty, and governance neutrality.

- To balance monetary sovereignty with innovation, Korea should pursue a dual-track approach: allowing non-bank stablecoin experiments within regulatory sandboxes, while promoting institutional stablecoins led by commercial banks.

The full report "A Strategic Framework for the Coexistence of the Three Pillars of Digital Currency" written by DeSpread Head of Strategy @Earl_Senor can be accessed through the links below⤵️

ENG:

KOR:

JPN:

ZH:

1,73K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin